As the U.S trade war with China continues and signs of a global economic slow-down mount, it seems that a recession may be just around the corner. And even though the U.S. is celebrating the longest period of economic expansion in history and unemployment hovers at a historic low, it’s imperative that investors prepare for the possibility of a bear market.

A bear market is a period in which prices fall 20 percent or more1 in either the general market or a specific market sector. Understandably, the prospect of seeing the value of your investments drop by 20 percent can be daunting, but–with a little faith—you and your assets can weather the bear market storm and escape without getting mauled.

Facing your fears

At first sight of the fearsome bear market, you may have the urge to run and sell off your assets, but history tells us you’re likely much better off holding on to your investments. Market volatility and recessions are normal characteristics of our financial system. In fact, there have been 15 recessions2 of various lengths and severity since 1925, and the U.S. economy and stock market have always bounced back. For example, throughout the history of the S&P 500 Index (1926-2018), the average annual return has been approximately 10 percent3.

Historically, the markets have always trended upwards, so selling during a dip is one of the worst things you can do for your investments. Hunkering down and holding on tight to your investments is usually a good strategy, metaphorically speaking. Remember, it isn’t a loss until you sell.

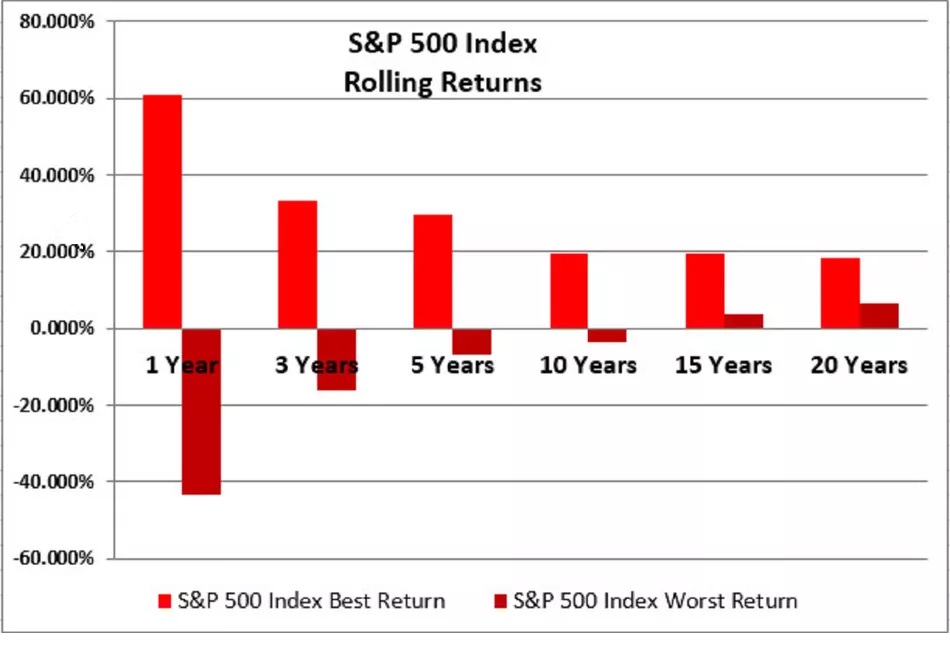

The following graph displays the 1, 3, 5, 10, 15, and 20-year rolling index returns of the S&P 500 Index from January 1973 to December 2016. It shows the difference between the worst one-year rolling return of the S&P 500 Index and the worst 20-year rolling return. As you can see, the worst rolling return for the one-year timeframe was -43% while the worst for the 20-year timeframe was 6.4%. This shows the increased security of longer-term investing.

Think you can time the market?

If for some unlikely reason you are a bear market whisperer and able to accurately predict its arrival, one strategy is to sell off your investments and invest in stable vehicles, such as short-term government bonds, or to simply hold onto your cash. In this strategy, you avoid the loss of value by preempting the bear market, but you also risk losing out on gains when the market rebounds, unless of course you’re a bull market whisperer too. The truth is no one can time the market, so, to continue our metaphor, this strategy will likely just leave you starving out in the woods.

Use bear armor

I realize this is an inelegant metaphor but bear with me.

One strategy to weather the bear market storm is to invest in large, stable companies with plenty of cash on hand. Investments in these companies are called defensive stocks because they generally have a better ability to withstand downturns in the market. Because of this, their stock prices are usually more resilient than smaller growth stocks, which are more susceptible to a drop in value. The financial stability of these companies provides your investments with a defense against the ravenous bear market.

Talk to your financial professional, bears don’t always have to be bad news

Recession and bear markets always have different causes and characteristics, so how you respond or prepare for them will depend on the specific situation. Because of this, you should speak with your financial professional about how you can survive the next bear market.

For more financial information, follow NEXT Financial Group, Inc. (NEXT) on Facebook and LinkedIn.